Long record of experience in acquisitions

We maintain a high rate of acquisition, typically acquiring several companies each year. These acquisitions have accounted for a large share of Indutrade's sales growth. Future growth is also expected to be achieved in part through company acquisitions. Indutrade is a long-term owner, and the companies, once acquired, are not subject to further sale.

Good conditions for value-creating acquisitions

Through a network of customers, suppliers, market actors and advisors Indutrade has good leads to potential acquisition candidates in the market. Due to the fragmented market structure, access to acquisition candidates is good. By virtue of its strong acquisition history, its size and its good reputation, Indutrade has the experience and conditions needed to carry out value-creating acquisitions.

What kind of companies do we acquire?

Our business philosophy builds upon entrepreneurship, decentralisation and sustainable, profitable growth.

What we're looking for:

- Only B2B companies

- Shared values and a management team that wants to stay involved after the acquisition

- Annual sales of SEK 50–500 million

- Stable, good profitability

- Both manufacturing companies with a proprietary product range and technical trading companies

- Sustainable leading market position in a well-defined niche

- Products with a high technical content that create added value for the customer

- High percentage of repetitive sales

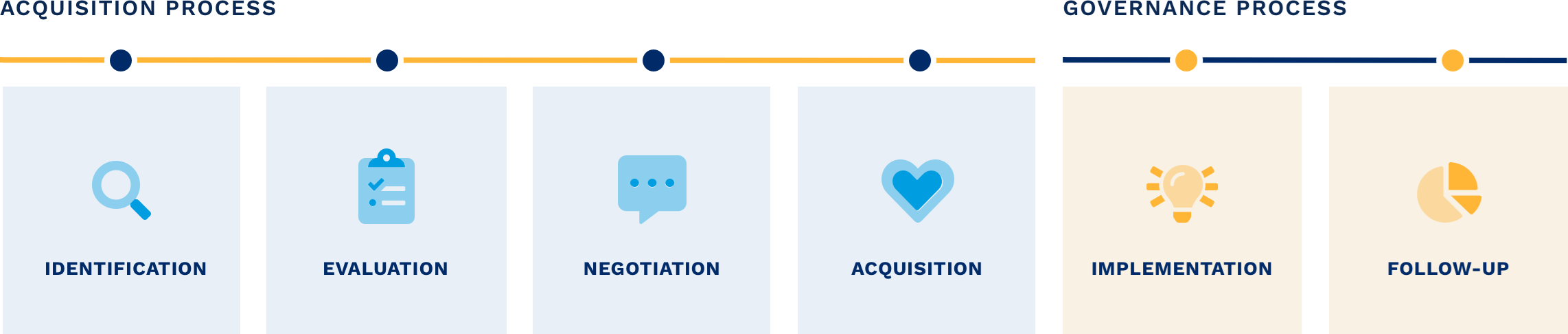

Well structured acquisition process

The pre-acquisition process might sometimes last for several years, during which time we meet managers and employees frequently to ensure that they are an “Indutrade company”. We strive to, as early as possible during the acquisition process, discuss our decentralised governance model and fundamental values with the seller.

Read more in-depth about the different steps

Our acquisition process is flexible and predictable, which has given us the opportunity to carry out a number of company acquisitions with certain advisors. Indutrade has a well-developed network of corporate advisors.

Contact the Business Development Team!

Are you interested in selling your company, or do you want to know more about how we work? Please contact Jonas Halvord, Gustav Ruda, Johan Lundberg or Fredrika Bruu