Funding risk

Indutrade takes a central approach to the Group’s funding. In principle, all external funding is conducted by the Parent Company, which then funds the Group’s subsidiaries, both in and outside Sweden, in local currency. Cash pools are established in Sweden, Finland, Norway, Denmark, Germany, the Netherlands and the UK.

Indutrade has had a commercial paper programme in place since

2014. As of the end of the financial year, the framework of the programme

was SEK 3,000 million. Indutrade also has a Medium Term Note programme (MTN) with a framework amount of SEK 10,000 million.

During the first quarter of 2021, Indutrade AB obtained a long-term credit rating of BBB- with stable outlook from S&P Global Ratings.

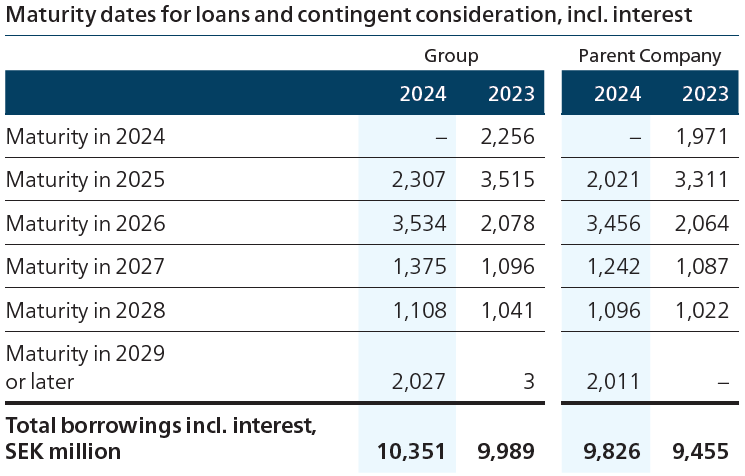

The Group’s interest-bearing net debt was SEK 8,206 million (7,747)

at year-end 2024. The Group had SEK 3,054 million (3,012) in cash and cash equivalents and SEK 6,295 million (6,235) in unutilised credit commitments.

Maturity profile – financing1), 31 December 2024

The Group strives to maintain a reasonable balance between equity,

debt financing and liquidity, to enable the Group to secure funding at

a reasonable capital cost. The Group’s goal is that the net debt/equity

ratio, defined as interest-bearing liabilities less cash and cash equivalents

in relation to equity, normally should not exceed 100%. At year-end 2024

the net debt/equity ratio was 49% (53%).